Ssdi tax calculator

Amount of Annual. Please remember that these calculators are for informational and educational purposes only.

Social Security Benefits Tax Calculator

The SSDI index looks at average wage indexes and applies them to a beneficiarys average current earnings.

. A Social Security break even calculator can help with the decision but it can never be the sole factor used if you are serious about making a well-rounded decision. The calculator below will estimate your monthly child support payment based on Marylands child support guidelines. However if you received a 10000 premium tax credit because you underestimated your 2021 income youll have to pay 3500 back.

Citizen or resident alien for the entire tax year. Having a low income or financial needs do not affect whether you can get SSDI. And when you go to file your 2020 tax return itll be on line 11 of the 2020 1040 federal tax.

For example if your 2021 income is 100000 you are required to pay no more than 8500 for ACA coverage. Before using this calculator Id highly encourage you to read my article or watch my video on the right way to use a Social Security break even calculator. If you receive other disability benefits such as Workers Compensation your benefits may be recalculated or reduced.

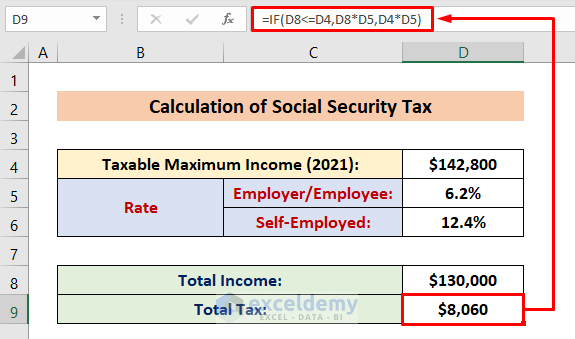

Many cases end up being approved after an appeal. Citizens or resident aliens for the entire tax year for which theyre inquiring. You can make the calculations on the IRS Form 1040 tax return or you can use Social Securitys tax calculator.

SSDI can also end if while still meeting the medical criteria for disability you are able to work and your income exceeds a limit known as substantial gainful activity SGA. In this situation an individual receiving the average SSDI benefit about 1361 a month as of April 2022 and no other income could qualify for Medicaid. The amount you get from SSDI will be based on how long you worked and how much Social Security tax also called FICA was taken from your pay.

27750 family of four or use other criteria to determine eligibility. Social Security disability benefits SSDI can be subject to tax but most disability recipients dont end up paying taxes on them because they dont have much other income. If married the spouse must also have been a US.

This may take place based on the SSDI index which is also the same index used to compute all Social Security benefits. Intercept state and federal tax refunds. You can find that figure on line 8b of the 2019 1040 tax form and line 7 on the 2018 1040 tax form.

Basic information to help you determine your gross income. The calculator below will estimate your monthly child support payment based on Louisianas child support guidelines. Amount of Monthly Income.

On average SSDI recipients receive between 800 to 1800 in monthly payments with an average of 1258 per month but the actual amount varies from case to case. If a silver plan for your family costs 15000 you are entitled to a 6500 premium tax credit. However some states set the cap at 100 percent of the poverty level 13590 individual.

Federal income tax withheld. The Social Security Administration SSA uses a weighted formula to calculate benefits for everyone. Report the delinquent payer to the credit bureau.

If you get turned down for SSDI reapply and appeal if necessary. By income assignment intercepting state and federal tax refunds and lottery winnings suspending licenses and registration denying passports and requesting a contempt of court charge the SES can penalizeand attempt to. The tool is designed for taxpayers who were US.

In 2022 the limit is 1350 per month or 2260 if you are blind.

This Social Security Planner Page Explains When You May Have To Pay Income Taxes On Your Social Security Benefits Income Tax Income Social Security

Taxable Social Security Benefits Calculator Youtube

Pin On Spreadsheets

Social Security Disability Benefits Pay Chart 2020

A New Report Analyzes How Each State Taxes Or Does Not Tax Social Security Income Social Security Benefits State Tax Social Security

Social Security Benefits Tax Calculator

How To Calculate Social Security Tax In Excel Exceldemy

Social Security Benefits Tax Calculator

Accounting Finance Ous Royal Academy Switzerland In 2022 Accounting And Finance Financial Management Accounting

Resource Taxable Social Security Calculator

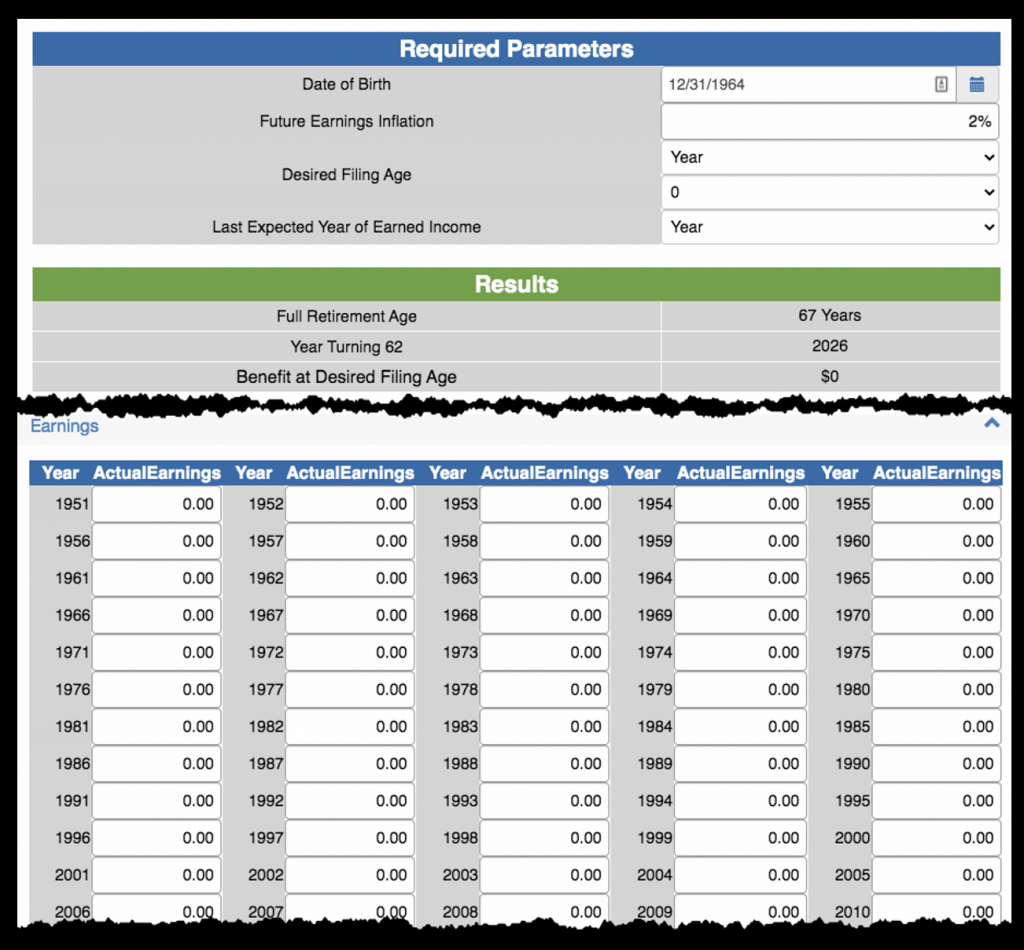

Calculators Social Security Intelligence

Quick Calculator Social Security Disability Social Security Benefits Financial Calculators

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Payment Differences Between Ssdi And Ssi Disability Benefits Center Ssi Supplemental Security Income Payment

Quick Calculator Social Security Disability Social Security Benefits Financial Calculators

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Social Security Benefits Tax Calculator